Insurance Technology and E & O Claims: What’s the Connection? (Part 1 of 4)

Part 1: Understanding the Digital Ecosystem

Kitty Ambers, CIC, CPIA, CISR

Chief Operating Officer, AVYST

Independent insurance agencies are striving to deploy technology that offers the promise of providing consumers with a convenient, engaging, and meaningful digital experience. As part of selecting and implementing new technology, it’s critical for agency leaders to consider the impact these solutions may have on the agency’s potential errors and omissions exposure.

There are a variety of operational elements to consider as part of any technology selection and implementation process. These include: Understanding The Digital Ecosystem and Consumer Expectations, Considering InsurTech and its Impact on Errors & Omissions, Digitization of Sales & Service Touchpoints, and Methods for Protecting the Investment in your Agency.

The goal of this blog series is to provide some practical ideas that will help empower you and your team to meet and exceed the standard of care owed your clients.

The Digital Ecosystem

A digital ecosystem is a group of interconnected information technology resources that can function as a unit. Technology is shaping consumer expectations for how agents operate and creating a high tech yet high touch customer experience is vital to compete. Agencies must find ways to pull all customer touchpoints together with seamless integration and data transfer between industry players and provide an excellent 24/7 customer experience.

At the heart of a digital ecosystem is the concept of interconnectedness. The goal in insurance agencies is to create a customer experience that reflects high tech capabilities yet is high touch when it comes to the customer relationship. To do this, we must be able to seamlessly integrate all the touchpoints, and accurately and securely transfer data between the various systems in play. By mindfully creating an effective digital ecosystem for your agency, you are setting yourself up to compete at a new level.

To summarize, in a complete digital ecosystem, insurance agents can source, quote, bind, support, and communicate with customers instantly, automatically and securely.

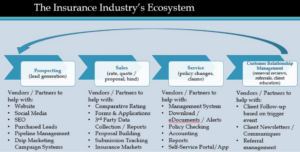

Look at the chart above. This is a very simplified look at the insurance ecosystem from the agency perspective – we find prospects, we prepare and present coverage options, we land the account which then means we service the account, and we (hopefully) are proactively managing the relationship by continuing to educate our clients, which in turn should lead to referrals so the process starts again. There is a myriad of technology at every one of these touchpoints. That’s where the average agency can get a bit stuck. For each area, there are numerous vendors or partners who might be able to offer a solution that fits with your agency’s business strategy. It’s a lot to think about!

Consumers Expect Technology to Deliver Better Experiences

As consumers, we’ve been conditioned to expect a lot from technology. As we ponder and create our digital ecosystem, we must remember that our clients really aren’t any different from us as consumers.

Let’s look at some data regarding consumer expectations around technology. In the 2019 State of the Connected Customer report from Salesforce, Seventy-five percent of customers expect companies to use new technologies (like artificial intelligence and the Internet of Things) to create better experiences; and 74% expect companies to use existing technologies in new ways to create better experiences. By understanding expectations and continuously considering ways to connect across the ecosystem, you are better able to position your agency to successfully meet and exceed evolving consumer expectations. Many times, system updates incorporate newer technologies automatically so it’s important stay abreast of what is included in system upgrades.

The Salesforce study also highlights what methods Customers prefer to use when communicating with the firms they do business with. You’ll see that these vary and include both online and offline tools and platforms. Also notice that the results from the Salesforce study indicate preferences by Generation.

- Dark Green = Millenials and GenZers – born since 1980 (under 40)

- Middle Green = Gen Xers (1965-1979) – ages 40 – 55 today

- Lightest Green = Baby Boomers (1946-1964) and the Silent Generation (anyone 56 and over)

Some of these results seem a bit surprising to me – like the use of Email, In-person and Telephone interactions – the assumption I hear is that the millennials want to do everything on their smartphone, so the study seems to contradict that slightly.

It’s not real surprising that Online, Mobile and Social Media options are not a big favorite of the Boomers.

I do think this chart tells us a couple of things as insurance agents:

- We need to be agile and able to conduct business on a wide range of technology platforms to effectively reach the 5 different generations.

- We need to be very strategic, as leaders, to ensure our business model, communication strategy, agency operations, trading partners and vendors are all aligned.

Who is driving expectations of your agency’s customer experience?

Another point from the State of the Connected Customer report to highlight is that 73% of customers say one extraordinary experience raises their expectations of other companies. We used to hold up Neiman Marcus as the epitome of customer service, however, today we have to think AMAZON and Zappos. This highlights a tricky reality for agents: today, you are in competition with every other company, regardless of industry.

So, what does this say about customer expectations and how we need to think about our insurance agency marketing and sales strategy? Basically, we need to consider the end-to-end customer experience we offer and find ways to embrace digital transformation. In our agencies, we used to think of the use of automation as focused primarily on back-office functions. However, with the InsurTech environment, technology is becoming increasingly customer-facing.

Customers expect relevant content in relation to what they’re doing anytime, anywhere and in the format and on the device of their choosing.

Customers Expect “Connectedness”

According to the Salesforce survey, 78% percent of customers expect connected experiences and consistent interactions (that is, where their preferences are known across touchpoints and any required information can be quickly accessed). Yet 59% of customers reported that their experiences are disconnected, and it feels like they are communicating with separate entities rather than one company. Because as insurance agents, we work with such a broad array of vendors and trading partners – this is something we must really take to heart as we explore how we make our various tools talk to each other.

The Insurance Industry’s Ecosystem

Consider a very real scenario of an insurance consumer. They visit your website. Is it attractive enough to keep them? Does it provide them with a way to reach out and contact the agency 24/7? Does the contact form submitted provide good direction and next steps? Does this lead get queued up for someone to act on promptly in the manner the prospect wishes to be contacted? Has enough information been collected to have a meaningful first conversation or interaction?

Another scenario might be a customer claim experience. Was the client educated when they were onboarded with your agency to know what to do in case of a claim? If they are directed to the claim’s hotline of the carrier, does the carrier support 24/7 access? Is the agency quickly notified of the claim through claims download or an alert? What is the agency’s process for following up and tracking the claim activity? At renewal time, you shouldn’t have to ask if there’d been any claim activity in the past year – you should already have the details and the claim status in your systems.

Well-planned and implemented technology can make these kinds of scenarios a positive experience for your clients and your firm.

********

About AVYST

AVYST eForms Wizard provides sales professionals with a digital solution to gather complete and accurate information at the point of sale. The ability to enter data once, directly onto digital eForms, minimizes errors and omissions. Learn more at www.avyst.com/go.

Don’t miss our future blog posts!