Insurance Technology and E & O Claims: What’s the Connection? (Part 3 of 4)

Part 3: Digitization of Sales & Service Touchpoints

Kitty Ambers, CIC, CPIA, CISR

Chief Operating Officer, AVYST

Insurance Activities that can benefit from Digitization

In a recent article published in National Underwriter, the author explains his view of the balance between human input and digitization. He makes an excellent point:

“There is a time for everything: a time for human guidance and a time for digitization,” ~ Zviki Ben Ishay

What are some of the key customer-facing activities that may benefit most from digitization?

- Before the policy sale: An easy-to-navigate website with clear and straightforward information about various insurance plans — and the ability for customers to begin the process – can be attractive to consumers.

- During the policy sale: Customers should be able to fill out an initial quote request form securely and easily, and submit documents, using nothing but the digital channel of their choice: smartphone or computer. At the point of sale, customers prefer to take the path of least resistance. By moving to a digital model for capturing data anywhere, anytime – in person or virtually – and getting sign offs completed using an e-signature solution – insurance agents reduce the probability of prospects dropping off due to excess friction.

- At the point of claim: Customers should be able to submit their FNOL, additional documents, sign, and get regular automated updates on their claim’s status through a single digital

channel. At the point of filing a claim, customers are already stressed due to an incident. Whether it’s a personal injury, vehicle damage, or property damage, the last thing overwhelmed customers want is to deal with difficult processes or to find that in 2022, they still need to find a fax machine.

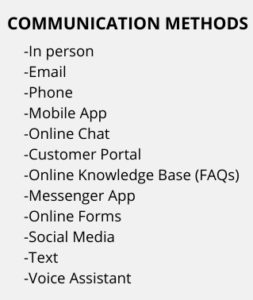

As we think about the various customer interaction touch points, we also must think about how various communication methods might be expected or can be better leveraged.

The Benefit of Automating

By seeking to automate or digitize much of the paperwork part of the insurance transaction – forms, documents, signatures – insurance professionals are freed up to do what only a human can do – that is provide guidance, advice, and direction to our clients. Automation allows us to create better client experiences which builds a more satisfying customer relationship. Happy customers stay with your agency.

Just like the risk management process you walk through with your clients, you should regularly walk through the processes and procedures in your agency from the consumer perspective. Work with your staff to brainstorm possible gaps in procedure and how to address them.

There are a variety of reasons why an error or omission occurs, and if we can reduce or eliminate those reasons or causes, we have gone a long way toward reducing or eliminating E & O exposures for the agency.

Loss Control Considerations – Sales, Service, and Technology

Begin by remembering that the leading cause of E & O claims is “failure to procure”. As agents, we have to always be thinking about risks we aren’t aware of – YET. We must understand that buying insurance isn’t like pulling up to the McDonald’s Drive Thru and ordering the #4 Super-Sized.

Clients rarely know what creates risk for them – like their dog’s breed, or the trampoline in the backyard. Never mind our commercial Bed & Breakfast client who thinks it’s OK to allow guests – for a few more dollars – to grab a gun from the gun cabinet and go hunting on the property. Or, the Contractor who had several pieces of large earth moving equipment and a big piece of land, so he decides to open an adult playground – think Tonka trucks in the sandbox on steroids. These are TRUE STORIES!

How does an agent learn about these things BEFORE claim time? We need to have solid, standard, proactive practices in place and our E & O carriers routinely point to using Checklists.

Seasoned veteran agents often dislike the idea of going through a lengthy questionnaire with a prospect or client. However, keep in mind that there are some additional benefits to using a thorough questionnaire or checklist.

- By using checklists, agents save time for themselves and their customers by tailoring the conversation to the customer’s exact coverage needs based on information already compiled in the coverage checklist.

- Checklists help customers identify unwanted or unknown exposures. For example, if a general contractor subcontracts a cabinet installer, and that subcontractor does not carry their own insurance, any problems on that jobsite could hit the general contractor’s insurance policy (a case known as “uninsured subs”). No business wants that exposure. By identifying this ahead of time, you can help your customer get the coverage they need – before it’s an issue.

- As we’ve already identified, consumers don’t usually speak insurance. Coverage checklists give agents an opportunity to educate customers about coverage choices that might otherwise seem confusing in written policy form or when filling out an online quote or renewal questionnaire. Through a thorough Needs Assessment, the best coverage options will emerge.

- Using a checklist to discuss coverages reminds agents to cross-sell other lines of insurance that fit customer needs, while improving the agency’s bottom line. The checklist guides conversation regarding insurance products the insured either does not have or has placed with another agent.

- Customers who feel educated about their best coverage options will tell their network about their great experience, creating the kind of advertising money can’t buy.

You can create your own checklist or questionnaire, or there are resources where you can find samples or purchase complete solutions. For example, the International Risk Management Institute (IRMI checklist) and Rough Notes have robust checklist solutions (Rough Notes Advantage Plus program).

Consider your agency processes around…

- Online Purchase Acknowledgement/Onboarding

- Coverage Review

- Declination of Coverage Form

- Electronic Policy Delivery

There’s an interesting challenge created by some of our insurance carriers. THEY are selling coverage online and then a local agency acquires or is assigned the account. This is a great way to gain new clients when your agency doesn’t have online sales capabilities, but if your agency has opted into this scenario, it’s critical that you have a well thought out onboarding process for welcoming these clients to your agency, reviewing the coverages they chose, and communicating additional coverage recommendations. Imagine, a prospect buys auto insurance online and you are “assigned” the account by the carrier. You think, wow, this is great – I’ve got a new client! But now it’s your responsibility to proactively review the policy – not only to ensure the client got the coverages they selected, but to ensure you’ve uncovered any additional exposures. The best way, obviously, is to have a conversation with the client. At a minimum, you should send a welcome, and encourage a coverage review. You might also consider using a variation on the declination of coverage theme to ensure that you’ve made your new client aware of the other coverages they should consider and that you can offer.

According to Dr. Billy Williams of Inspire a Nation, there are actually a number of times in the customer life cycle when a declination of coverage form can come in handy. Some of these include:

- When you spot a policy weakness on an endorsement request

- When conducting a customer policy review

- When you place a follow-up call after a claim is reported

Like our agencies, we know that many of our carriers have gone paperless. Before sending policy documents to clients digitally / electronically, the agency should obtain a signed authorization form from the client. While you can go online to your carriers to view copies of their Consent Forms, there is actually an ACORD form (ACORD 68) for this purpose. This form:

- Defines “Electronic Delivery” – includes delivery to an email address which you have consented to receive notices or documents, OR posting on an electronic network or website accessible via internet, mobile application, computer, mobile device, tablet or any other electronic device.

- Encourages the client to indicate their preferences – electronic, electronic and paper, reject electronic delivery completely, or withdraw consent if previously accepted.

If your agency practice is to send policy documents electronically or has a client portal or mobile app that you are using to communicate policy details to clients, ensure that some kind of Consent Form – ACORD or similar – is incorporated into your sales and service workflows. You will also want to check your state insurance regulations regarding Records Retention of these forms.

Client Communication & Documentation

You likely learned very early on in your insurance career – “Document, Document, Document”. We also know that the strongest defense an agency can mount in the event of an E & O allegation is thorough and accurate documentation.

With so many communication platforms these days, however, it makes it more and more challenging. We have email, voice mail, text messaging – either using an enterprise solution for the agency or using personal cell phones. We may have online chat via our website and potentially Facebook messaging – not to mention communication with prospects and clients via other Social Media platforms. It can be overwhelming, but it’s a reality in our ultra-connected world.

Again, be mindful of the communication channels at play in your agency and ensure you have a consistent practice in place for documenting each and every interaction.

- After every client interaction – whether electronic or verbal and whether the communication took place while in the agency or not – employees should enter a summary into the agency management system or a client communication log. If there’s a follow-up needed, be sure to set a reminder or suspense item. This can require diligence – especially for producers who are routinely out of the office or on back-to-back calls. Sending yourself a quick message, even using voice assistance or talk to text, can help.

- COVID CAUTION – people are reading policies and asking more questions these days – Caution your staff to be clear with their answers while not overstating what a policy covers. Documentation should describe the questions asked as well as the responses given. I’d recommend going one step farther by sending a written recap, maybe with some sort of article or informational document, where appropriate.

Well documented, real time client communications are more important than ever as employees are working remotely. Think about a rotational servicing workflow for example – if one agent takes a call, answers questions, and provides guidance to a client and the client calls back, and gets another agent before the first agent can enter a summary of the first call, we run the risk of contradicting ourselves. This can spell E & O.

As a way to keep your entire team on the same page when they are working remotely, consider videoconferencing with your team every morning so employees can share concerns and troubleshoot challenging issues. Employees may be facing new situations or questions from clients that are emerging from the pandemic. Help your employees gain confidence so they can educate clients about relevant coverage concerns.

I hope that these various scenarios have the wheels turning with regard to your agency procedures and where you might need to take a step back and re-evaluate that you and your team have covered all the basics. It’s a lot to consider – and it likely will continue to unfold and evolve.

Additional resources: Understanding the Digital Ecosystem (part 1 of this series); InsurTech and the Impact on Agents’ E & O (part 2 of this series)

Cover photo, NU Property Casualty 360

********

About AVYST

AVYST eForms Wizard provides sales professionals with a digital solution to gather complete and accurate information at the point of sale. The ability to enter data once, directly onto digital eForms, minimizes errors and omissions. Learn more at www.avyst.com/go.

Don’t miss our future blog posts!

channel. At the point of filing a claim, customers are already stressed due to an incident. Whether it’s a personal injury, vehicle damage, or property damage, the last thing overwhelmed customers want is to deal with difficult processes or to find that in 2022, they still need to find a fax machine.

channel. At the point of filing a claim, customers are already stressed due to an incident. Whether it’s a personal injury, vehicle damage, or property damage, the last thing overwhelmed customers want is to deal with difficult processes or to find that in 2022, they still need to find a fax machine.